All Categories

Featured

Table of Contents

- – Value Accredited Investor Opportunities

- – Private Equity For Accredited Investors

- – World-Class Private Equity For Accredited Inv...

- – Recommended Venture Capital For Accredited In...

- – Accredited Investor Syndication Deals

- – Optimized Accredited Investor Investment Net...

- – All-In-One Private Equity For Accredited Inv...

The policies for accredited investors differ amongst territories. In the U.S, the interpretation of an approved capitalist is presented by the SEC in Policy 501 of Guideline D. To be a recognized financier, an individual must have a yearly revenue surpassing $200,000 ($300,000 for joint earnings) for the last two years with the assumption of gaining the exact same or a greater earnings in the current year.

This amount can not include a key house., executive police officers, or supervisors of a business that is providing non listed safeties.

Value Accredited Investor Opportunities

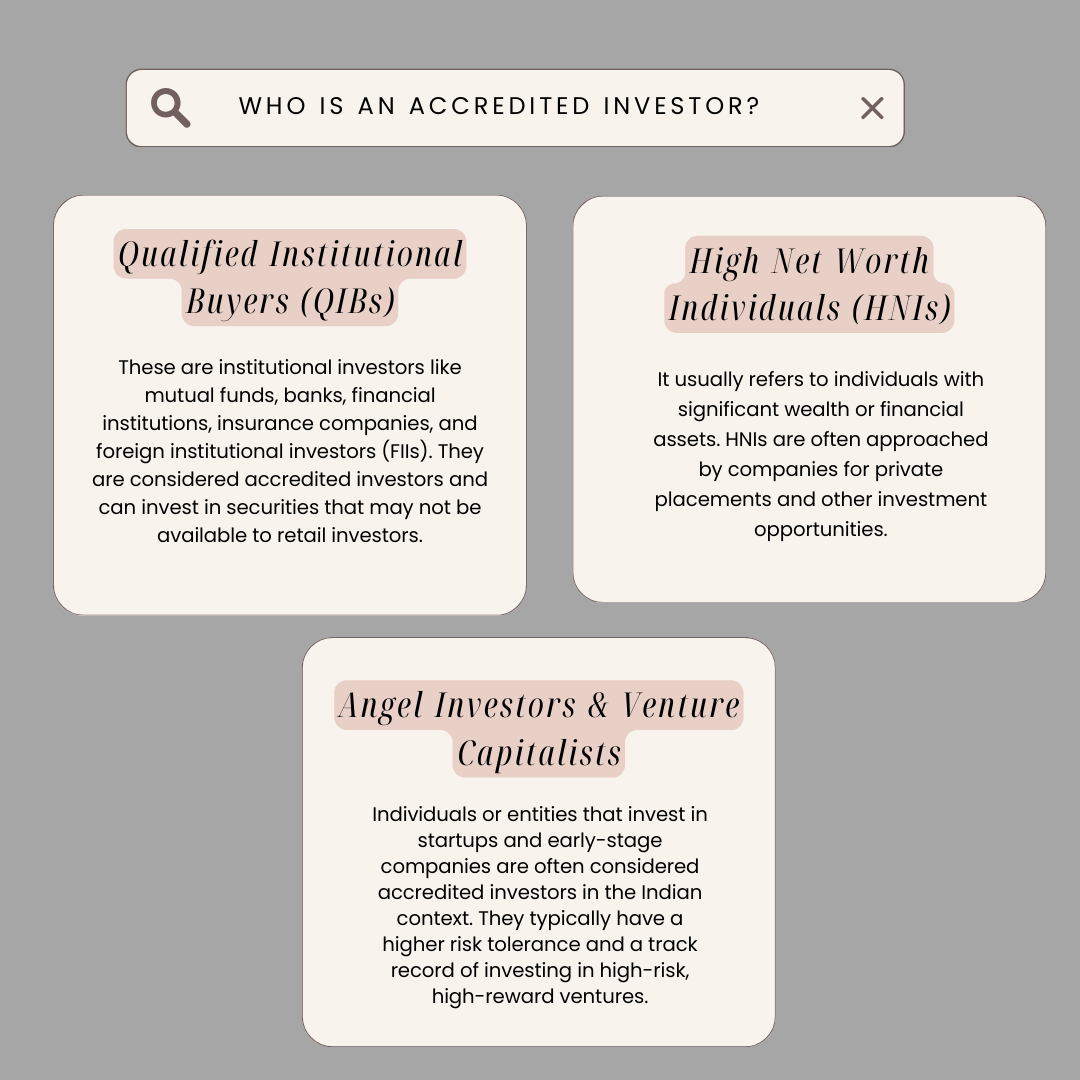

If an entity is composed of equity owners that are approved capitalists, the entity itself is an accredited investor. An organization can not be developed with the single purpose of purchasing specific safeties. An individual can certify as a certified financier by showing enough education and learning or work experience in the economic sector

Individuals who wish to be accredited financiers do not apply to the SEC for the designation. Rather, it is the obligation of the firm providing an exclusive placement to see to it that every one of those come close to are approved capitalists. People or celebrations who intend to be recognized financiers can approach the provider of the non listed safeties.

Suppose there is a private whose earnings was $150,000 for the last three years. They reported a key house value of $1 million (with a home mortgage of $200,000), a vehicle worth $100,000 (with an outstanding lending of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

This person's net well worth is specifically $1 million. Since they fulfill the net well worth demand, they certify to be a certified financier.

Private Equity For Accredited Investors

There are a couple of much less common credentials, such as handling a trust fund with greater than $5 million in assets. Under government protections laws, only those that are certified investors may join certain protections offerings. These may consist of shares in personal placements, structured items, and private equity or hedge funds, to name a few.

The regulators intend to be particular that individuals in these highly risky and intricate investments can take care of themselves and evaluate the threats in the lack of government defense. The certified investor regulations are created to shield possible investors with restricted economic understanding from high-risk ventures and losses they may be ill equipped to endure.

Certified capitalists meet credentials and specialist standards to accessibility unique investment opportunities. Designated by the U.S. Securities and Exchange Commission (SEC), they get access to high-return choices such as hedge funds, equity capital, and private equity. These financial investments bypass complete SEC registration yet lug greater dangers. Certified investors have to satisfy earnings and total assets needs, unlike non-accredited people, and can spend without constraints.

World-Class Private Equity For Accredited Investors

Some essential modifications made in 2020 by the SEC include:. Including the Collection 7 Collection 65, and Series 82 licenses or other qualifications that reveal financial competence. This adjustment acknowledges that these entity types are typically used for making investments. This modification recognizes the knowledge that these employees develop.

These changes increase the recognized financier pool by approximately 64 million Americans. This wider gain access to offers a lot more chances for capitalists, yet also raises possible threats as much less monetarily innovative, financiers can take part.

One major benefit is the chance to purchase positionings and hedge funds. These financial investment alternatives are unique to certified financiers and establishments that qualify as an approved, per SEC regulations. Exclusive placements make it possible for business to secure funds without navigating the IPO treatment and governing documentation required for offerings. This offers accredited investors the possibility to buy emerging companies at a phase before they consider going public.

Recommended Venture Capital For Accredited Investors

They are viewed as investments and are obtainable just, to certified clients. Along with known business, certified investors can pick to purchase startups and promising ventures. This offers them income tax return and the possibility to get in at an earlier stage and potentially reap rewards if the firm prospers.

Nonetheless, for investors available to the risks involved, backing start-ups can bring about gains. A number of today's tech companies such as Facebook, Uber and Airbnb came from as early-stage startups supported by certified angel investors. Advanced capitalists have the chance to check out investment alternatives that might yield a lot more revenues than what public markets provide

Accredited Investor Syndication Deals

Although returns are not guaranteed, diversification and profile enhancement alternatives are expanded for capitalists. By expanding their portfolios via these broadened financial investment opportunities recognized investors can boost their techniques and potentially accomplish superior long-term returns with appropriate threat management. Experienced investors usually experience financial investment choices that might not be easily available to the general investor.

Investment options and securities offered to recognized financiers generally involve greater dangers. Private equity, endeavor funding and bush funds frequently concentrate on spending in assets that lug threat but can be liquidated easily for the opportunity of greater returns on those risky investments. Investigating prior to spending is crucial these in scenarios.

Lock up periods prevent financiers from withdrawing funds for more months and years at a time. There is also much much less openness and regulatory oversight of personal funds contrasted to public markets. Capitalists might battle to properly value exclusive possessions. When managing threats accredited financiers need to assess any type of exclusive financial investments and the fund supervisors included.

Optimized Accredited Investor Investment Networks for Accredited Investment Results

This adjustment may extend recognized financier status to a range of individuals. Upgrading the income and property standards for rising cost of living to ensure they show adjustments as time advances. The current thresholds have actually stayed fixed since 1982. Permitting companions in committed connections to incorporate their resources for common qualification as recognized investors.

Allowing people with specific specialist accreditations, such as Collection 7 or CFA, to qualify as accredited investors. Creating extra needs such as evidence of financial literacy or effectively completing an approved financier test.

On the various other hand, it could likewise lead to seasoned investors assuming excessive risks that might not appropriate for them. Safeguards might be needed. Existing certified investors may face boosted competitors for the very best financial investment chances if the swimming pool expands. Firms raising funds might take advantage of a broadened certified financier base to draw from.

All-In-One Private Equity For Accredited Investors

Those who are presently thought about recognized financiers have to remain upgraded on any kind of changes to the requirements and regulations. Their eligibility may be subject to modifications in the future. To preserve their status as recognized capitalists under a changed interpretation changes may be necessary in wide range management techniques. Services looking for certified investors need to stay watchful about these updates to ensure they are drawing in the right target market of investors.

Table of Contents

- – Value Accredited Investor Opportunities

- – Private Equity For Accredited Investors

- – World-Class Private Equity For Accredited Inv...

- – Recommended Venture Capital For Accredited In...

- – Accredited Investor Syndication Deals

- – Optimized Accredited Investor Investment Net...

- – All-In-One Private Equity For Accredited Inv...

Latest Posts

Tax Ease Lien Investments 1 Llc

Is Buying Tax Liens A Good Investment

Delinquent Houses For Sale

More

Latest Posts

Tax Ease Lien Investments 1 Llc

Is Buying Tax Liens A Good Investment

Delinquent Houses For Sale