All Categories

Featured

Table of Contents

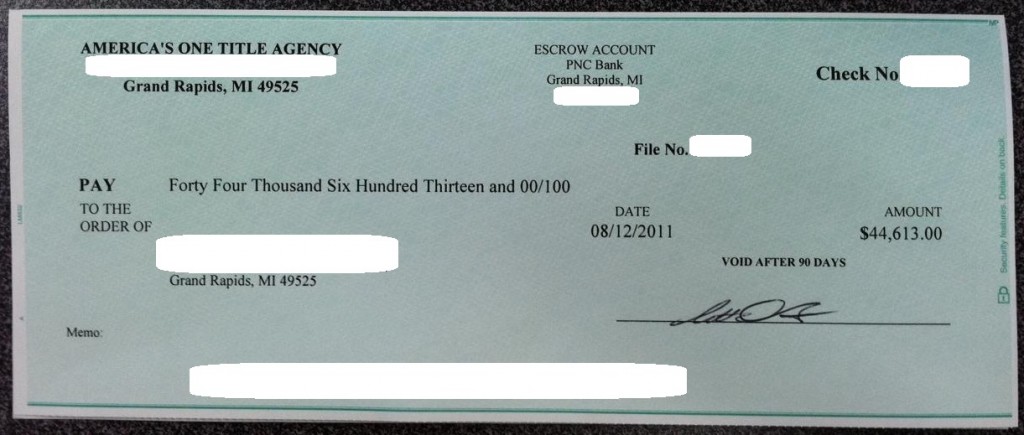

This beginning number mirrors the tax obligations, fees, and passion due. After that, the bidding process begins, and multiple capitalists increase the price. Then, you win with a quote of $50,000. Consequently, the $40,000 rise over the original bid is the tax obligation sale excess. Declaring tax obligation sale excess indicates acquiring the excess money paid during an auction.

That claimed, tax obligation sale overage insurance claims have shared characteristics throughout the majority of states. Throughout this period, previous owners and mortgage owners can call the region and obtain the excess.

If the period expires prior to any interested parties declare the tax sale overage, the area or state usually absorbs the funds. Past proprietors are on a stringent timeline to insurance claim overages on their properties.

, you'll gain passion on your whole proposal. While this facet does not mean you can declare the overage, it does help alleviate your expenses when you bid high.

Award-Winning Tax Foreclosure Overages Guide Foreclosure Overages

Bear in mind, it might not be lawful in your state, implying you're limited to accumulating interest on the overage. As specified above, an investor can discover means to benefit from tax sale overages. County Tax Sale Overage List. Since rate of interest income can put on your whole proposal and past proprietors can claim overages, you can leverage your knowledge and tools in these situations to make the most of returns

A vital element to remember with tax sale overages is that in many states, you only need to pay the region 20% of your overall proposal up front. Some states, such as Maryland, have legislations that exceed this rule, so again, research your state laws. That stated, the majority of states follow the 20% regulation.

Rather, you just require 20% of the proposal. If the property doesn't redeem at the end of the redemption duration, you'll need the staying 80% to obtain the tax obligation act. Since you pay 20% of your proposal, you can gain passion on an excess without paying the full cost.

High-Quality Property Tax Overages Training Tax Sale Overages

Once more, if it's lawful in your state and area, you can deal with them to aid them recoup overage funds for an extra fee. You can accumulate rate of interest on an overage bid and charge a fee to simplify the overage claim procedure for the previous proprietor. Tax obligation Sale Resources lately released a tax sale overages item specifically for individuals curious about seeking the overage collection company.

Overage collection agencies can filter by state, county, home type, minimum overage quantity, and optimum overage quantity. When the information has actually been filtered the collection agencies can make a decision if they want to include the miss mapped data bundle to their leads, and after that pay for just the validated leads that were located.

In addition, simply like any type of various other investment strategy, it offers special pros and cons.

All-In-One Property Tax Overages System Tax Overages List

Otherwise, you'll be at risk to unseen risks and lawful ramifications. Tax sale overages can create the basis of your investment model due to the fact that they offer an inexpensive means to earn money. For example, you do not need to bid on buildings at auction to invest in tax sale excess. Rather, you can research existing excess and the past proprietors who have a right to the cash.

Doing so doesn't set you back thousands of hundreds of bucks like purchasing several tax obligation liens would. Instead, your study, which may include skip tracing, would set you back a fairly small fee. Any state with an overbid or exceptional quote approach for public auctions will have tax sale overage chances for financiers. Remember, some state statutes stop overage choices for previous proprietors, and this issue is in fact the subject of a current Supreme Court situation.

Unclaimed Tax Sale Overages Bob Diamond Overages

Your sources and approach will certainly identify the best setting for tax overage investing. That stated, one strategy to take is gathering interest on high premiums.

Any auction or repossession including excess funds is a financial investment chance. You can spend hours looking into the past owner of a residential or commercial property with excess funds and contact them only to find that they aren't interested in pursuing the money.

You can start a tax overage service with very little expenses by finding information on recent residential or commercial properties cost a costs bid. After that, you can speak to the past proprietor of the residential or commercial property and offer a price for your solutions to assist them recover the excess. In this situation, the only price entailed is the research study rather than costs tens or numerous hundreds of dollars on tax liens and actions.

These excess generally produce interest and are available for past owners to insurance claim - Mortgage Foreclosure Overages. Whether you invest in tax liens or are entirely interested in insurance claims, tax sale excess are investment possibilities that need hustle and strong study to transform a revenue.

Secure Tax Sale Overage List Training Tax Overage Recovery Strategies

An event of rate of interest in the building that was marketed at tax obligation sale might designate (transfer or sell) his or her right to assert excess earnings to someone else just with a dated, created document that clearly specifies that the right to assert excess earnings is being designated, and only after each party to the suggested job has actually revealed to each various other celebration all truths relating to the worth of the right that is being assigned.

Tax obligation sale overages, the excess funds that result when a building is cost a tax sale for even more than the owed back taxes, costs, and expenses of sale, represent an alluring chance for the original homeowner or their successors to recoup some value from their shed possession. The process of claiming these excess can be complicated, stuck in lawful treatments, and vary considerably from one jurisdiction to one more.

When a property is marketed at a tax sale, the primary goal is to recover the overdue real estate tax. Anything above the owed amount, consisting of fines and the price of the sale, becomes an excess - Property Tax Overages. This excess is basically money that needs to rightfully be gone back to the previous residential or commercial property proprietor, presuming nothing else liens or insurance claims on the residential or commercial property take priority

Latest Posts

Tax Ease Lien Investments 1 Llc

Is Buying Tax Liens A Good Investment

Delinquent Houses For Sale