All Categories

Featured

Table of Contents

- – Most Affordable Accredited Investor Syndicatio...

- – Respected Accredited Investor Property Investm...

- – Favored Accredited Investor Secured Investmen...

- – Expert Accredited Investor Crowdfunding Oppor...

- – Best Exclusive Deals For Accredited Investors

- – High-Quality Accredited Investor Passive Inc...

- – Top-Rated Accredited Investor Financial Grow...

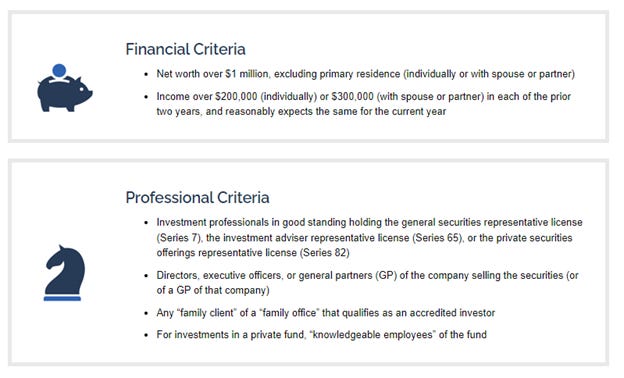

The laws for recognized financiers differ among territories. In the U.S, the interpretation of a certified financier is put forth by the SEC in Guideline 501 of Guideline D. To be an accredited investor, an individual needs to have an annual earnings surpassing $200,000 ($300,000 for joint revenue) for the last two years with the assumption of earning the exact same or a greater revenue in the existing year.

This quantity can not include a main residence., executive police officers, or supervisors of a company that is issuing unregistered safety and securities.

Most Affordable Accredited Investor Syndication Deals

Likewise, if an entity consists of equity owners who are recognized financiers, the entity itself is an accredited investor. Nevertheless, a company can not be created with the single function of acquiring details safeties - passive income for accredited investors. A person can qualify as a recognized investor by showing sufficient education and learning or job experience in the monetary industry

People who want to be certified capitalists do not apply to the SEC for the designation. Rather, it is the obligation of the company offering a private placement to ensure that all of those approached are approved capitalists. People or celebrations who intend to be approved investors can approach the issuer of the unregistered protections.

Expect there is an individual whose income was $150,000 for the last three years. They reported a main home value of $1 million (with a home loan of $200,000), an auto worth $100,000 (with an exceptional car loan of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

Internet worth is computed as properties minus obligations. This individual's internet worth is exactly $1 million. This entails a calculation of their assets (aside from their main home) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equating to $50,000. Considering that they meet the total assets need, they qualify to be a certified financier.

Respected Accredited Investor Property Investment Deals

There are a few much less typical credentials, such as managing a count on with greater than $5 million in assets. Under federal safety and securities legislations, only those who are recognized capitalists may join specific protections offerings. These might consist of shares in private placements, structured products, and private equity or bush funds, amongst others.

The regulatory authorities intend to be particular that participants in these extremely high-risk and complicated financial investments can look after themselves and judge the risks in the lack of federal government defense. The certified investor regulations are made to safeguard potential investors with limited economic knowledge from high-risk ventures and losses they may be unwell outfitted to withstand.

Certified capitalists fulfill qualifications and specialist criteria to access exclusive financial investment chances. Certified financiers have to fulfill earnings and web well worth demands, unlike non-accredited people, and can invest without limitations.

Favored Accredited Investor Secured Investment Opportunities

Some essential changes made in 2020 by the SEC include:. This adjustment recognizes that these entity kinds are often made use of for making investments.

These amendments increase the certified capitalist pool by around 64 million Americans. This larger access gives a lot more possibilities for investors, but also boosts possible dangers as much less monetarily sophisticated, capitalists can get involved.

One major benefit is the opportunity to invest in placements and hedge funds. These financial investment options are exclusive to accredited investors and establishments that certify as a certified, per SEC regulations. Personal placements enable companies to protect funds without browsing the IPO procedure and regulatory paperwork needed for offerings. This gives accredited investors the chance to invest in arising business at a phase before they take into consideration going public.

Expert Accredited Investor Crowdfunding Opportunities

They are considered as financial investments and are accessible just, to certified clients. In addition to known firms, certified financiers can pick to invest in start-ups and promising endeavors. This provides them tax returns and the opportunity to get in at an earlier stage and possibly reap incentives if the firm prospers.

For capitalists open to the dangers involved, backing start-ups can lead to gains (investment platforms for accredited investors). Numerous of today's tech business such as Facebook, Uber and Airbnb stemmed as early-stage startups supported by recognized angel financiers. Sophisticated investors have the possibility to check out financial investment alternatives that might generate more profits than what public markets use

Best Exclusive Deals For Accredited Investors

Returns are not ensured, diversity and portfolio improvement options are increased for financiers. By expanding their profiles with these broadened financial investment methods certified capitalists can improve their approaches and potentially attain exceptional lasting returns with appropriate risk administration. Seasoned financiers frequently encounter investment choices that might not be conveniently available to the general financier.

Financial investment options and protections used to recognized investors usually involve higher threats. As an example, personal equity, equity capital and bush funds typically concentrate on purchasing possessions that lug danger but can be liquidated easily for the opportunity of higher returns on those risky investments. Looking into prior to spending is essential these in situations.

Lock up durations prevent capitalists from taking out funds for even more months and years on end. Financiers may struggle to accurately value private possessions.

High-Quality Accredited Investor Passive Income Programs for Accredited Investors

This adjustment may expand accredited capitalist status to a series of individuals. Updating the revenue and possession criteria for inflation to guarantee they mirror modifications as time progresses. The current thresholds have actually remained static given that 1982. Permitting companions in dedicated connections to combine their sources for shared qualification as recognized investors.

Allowing individuals with specific expert certifications, such as Series 7 or CFA, to certify as recognized financiers. Developing added needs such as evidence of financial literacy or efficiently finishing an approved investor exam.

On the other hand, it can likewise result in knowledgeable capitalists assuming extreme dangers that might not be suitable for them. Existing recognized financiers might encounter enhanced competitors for the finest investment opportunities if the pool grows.

Top-Rated Accredited Investor Financial Growth Opportunities for Accredited Investor Platforms

Those who are presently thought about recognized investors need to remain upgraded on any changes to the standards and guidelines. Their eligibility might be subject to modifications in the future. To preserve their standing as recognized capitalists under a revised definition adjustments may be essential in riches administration strategies. Companies seeking certified investors need to stay attentive regarding these updates to ensure they are drawing in the ideal target market of capitalists.

Table of Contents

- – Most Affordable Accredited Investor Syndicatio...

- – Respected Accredited Investor Property Investm...

- – Favored Accredited Investor Secured Investmen...

- – Expert Accredited Investor Crowdfunding Oppor...

- – Best Exclusive Deals For Accredited Investors

- – High-Quality Accredited Investor Passive Inc...

- – Top-Rated Accredited Investor Financial Grow...

Latest Posts

Tax Ease Lien Investments 1 Llc

Is Buying Tax Liens A Good Investment

Delinquent Houses For Sale

More

Latest Posts

Tax Ease Lien Investments 1 Llc

Is Buying Tax Liens A Good Investment

Delinquent Houses For Sale